Fanny Jackson Coppin Scholarship

Fanny Jackson Coppin Scholarship

Coppin State University gets our name from our beloved namesake, Fanny Jackson Coppin. She was a pioneer who rose through slavery to transform her life through education. She transformed her life so she could transform the lives of others. Students selected for this prestigious scholarship are expected to follow in her legacy through academic excellence, campus engagement, and community service.

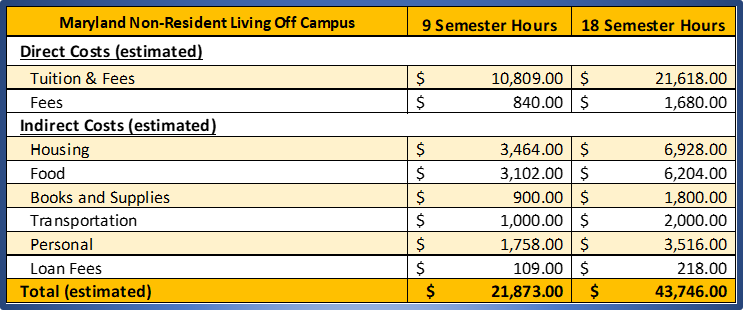

Scholars who will enroll in Fall 2025 or after are subject to the following conditions of the Fanny Jackson Coppin Scholarship: The Fanny Jackson Coppin Scholarship is a four-year, renewable scholarship covering tuition, fees and up to $1000/year in books. To qualify, a potential Scholar must be a current high school senior with a weighted high school cumulative grade point average of 3.3 or above. The test score requirements are an SAT score of 1140 or an ACT composite score of 23*. A potential Scholar must be a US citizen or a US permanent resident.

The scholarship is renewable provided the Scholar completes thirty (30) credit hours during the freshman year, enrolls in the Academic Excellence track via the Honors Program or the Leadership Excellence track, and maintains a cumulative 3.2 grade point average and resides on campus.

Scholars will select an Excellence track during summer orientation. Be sure to visit their webpages to learn more about each track.

Please contact the Office of Admissions for more details at 410.951.3610 or email admissions@coppin.edu.

*CSU is currently offering test optional admission. Other factors including submission of resumes and letters of recommendation may be considered in lieu of SAT and/or ACT scores.

For more details about the Fanny Jackson Coppin Scholarship requirements before 2025, please visit here.